Article

The Icelandic Krona: A Guide to the Nation's Currency

Iceland is one of the few countries in Europe that is not part of the European Union. Iceland also has its own central bank and its own currency, the Icelandic króna. This uniqueness gives Iceland the advantages and disadvantages of having its own monetary policy. For example, while the country is able to devalue the Icelandic currency to become more competitive, the Icelandic foreign exchange market is one of the most volatile in Europe. This creates opportunities for investors and arbitrageurs who can capitalise on these characteristics, particularly through bonds or bets against the local currency (ISK). Swapp Agency can guide you through the entire process.

Small Market, Big opportunities

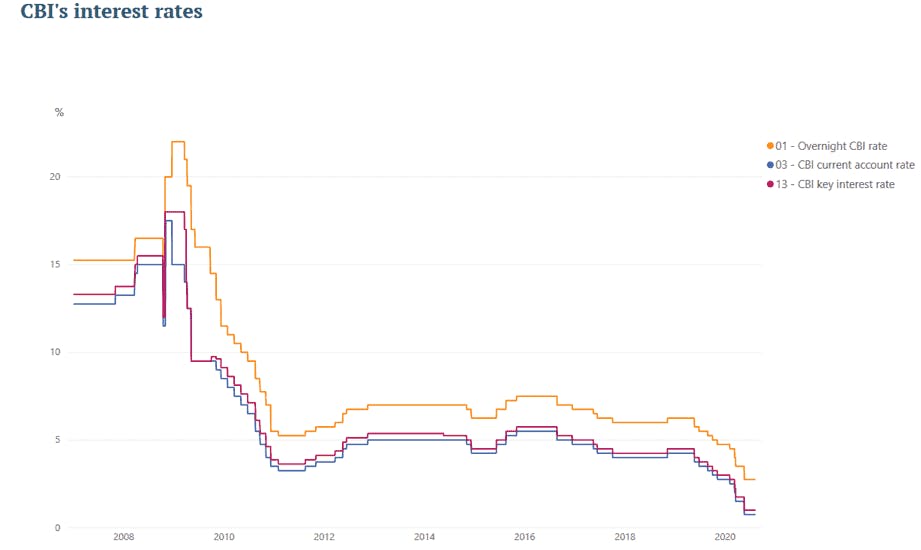

As the market is relatively small, macroeconomic trends and fluctuations have a strong influence on the value of the Icelandic krona. Since the beginning of 2020, money in Iceland has depreciated by 12%. As the flow of USD and EUR is mainly dependent on tourism, the impact of the pandemic has been devastating for the value of the national currency. The Icelandic central bank has decided not to support the value of the krona by selling dollars, but has doubled and lowered interest rates. Countries are promoting domestic tourism more than anything else and international flights and ferries are expecting a long-term decline in their market, affecting long-term USD and EUR inflows to Iceland.

Opportunities have arisen. You can take out a favourable loan in ISK (lower interest rates), but it is possible that the future value of the loan in hard currency (USD or EUR) will be lower as the krona depreciates. This means that you can invest in the króna by betting against it. (technically, this would not be an investment in the krona per se). Currently, the CBI rate is at 0.75%, while the inflation rate is more or less 3%, so a negative real interest rate. In addition, signs such as the PPP exchange rate show that the ISK is clearly overvalued: the price of a coffee is USD 3-5 and a beer USD 7.

Current commercial loans, for example, have annual fixed costs of around 4.5%. You can take out a loan in ISK and use it to buy USD or EUR in the expectation that they will lose value over the next 2-3 years. In the meantime, you can use the money to earn interest in USD or EUR.

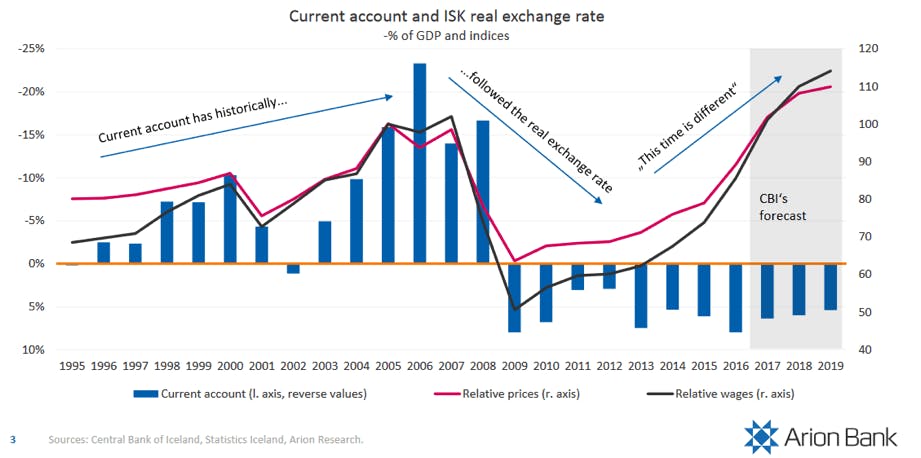

The chart shows a continuous deficit in the current account. A problem that should be partially reversed in the face of the pandemic, as USD / EUR are much less available due to lower tourism. The exchange rate is the way in which these relationships come into balance. Further depreciation is therefore expected.

Get in touch with Icelandic professionals

For comprehensive economic and currency-related advice, contact the Swapp agency. We are a leading group of experts in various fields. Our professional team will be happy to assist you throughout the entire process of investing in Iceland. Whether it's personnel, the acquisition of goods and services or finance, we are ready to answer all your questions.